Overview.

One of our key clients, operating in the professional services sector (>80,000 staff and >500 offices globally), required individual office insights (i.e. occupancy) and support in making key decisions. Our client has an office in the APAC region with 1,500 desks supporting circa 2,300 employees over five floors.

The corporate real-estate team had previously been relying on badge data for decision making but were getting complaints based on the lack of meeting room spaces and focused concentration spaces on the busiest days, which was discouraging people from returning to the office.

The Solution

Complete Workplace Visibility, Powered by Freespace Sensors.

Our solution was to deploy workplace sensors across all spaces so that data could be generated to support the decision making process. The approach included:

- Demonstrate value – using the new model to identify new pressure points and the potential for growth or savings

- Understand occupancy – using sensor data to understand patterns of usage and a better definition of busyness for the office

- Understand usage by type to identify pressure points – using patterns in usage across categories to identify when demand may outstrip supply

- Validate use of spaces – complete behavioral analysis of space types (dwell time & people counting) to validate need and align recommendations with actual requirements

- Model optimum design – integrating physical space metrics to re model space counts and show the updated occupancy

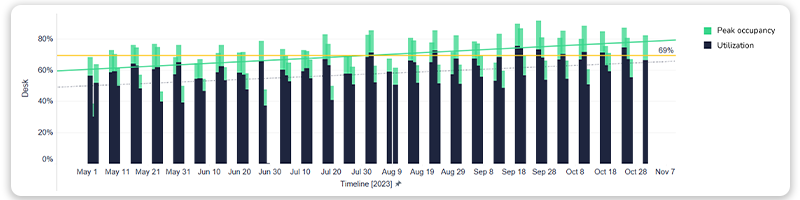

The graph identifies 6-months of desk usage, removing Mondays and Fridays (as the least busy days) to provide and accurate picture of a sustained period of time. The average daily peak occupancy is 69%, although there are many instances where days reach above 80%.

Analyzing the design of the floor.

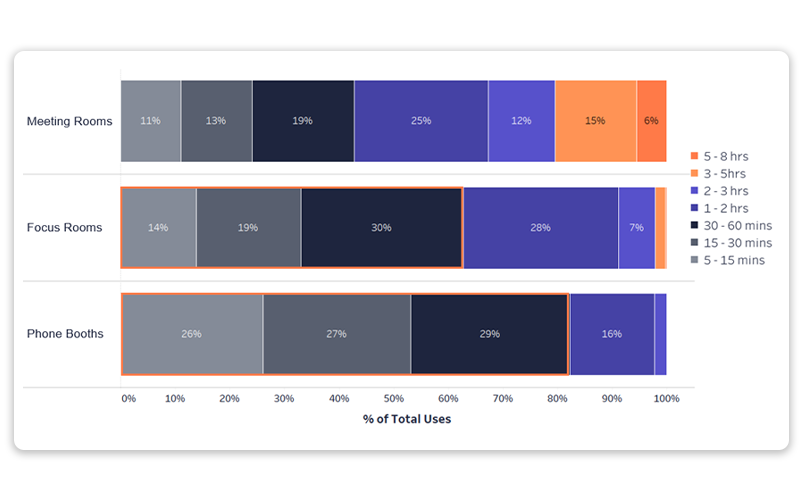

To support any future design, we examined behavior, efficiency and space usage to make the optimum suggestions based on how people used the floor. This included using dwell time measurements and when looking at the results for focus rooms, the majority of uses lasted less than an hour.

The outcome identified that focus rooms were used for short periods, which could be picked up by an increase in phone booth usage. Additionally, for meeting rooms, the majority of spaces had reasonable maximum user counts up until the largest rooms and whilst their 18 person space had value beyond its efficiency (being designed to represent the brand when accommodating key internal and external meetings) the two 14 person rooms were massively under-used and never had more than 8-10 people at once which the remaining large rooms could accommodate. The recommendation was to convert these two rooms into five smaller rooms.

Optimized floor design that holds up under pressure.

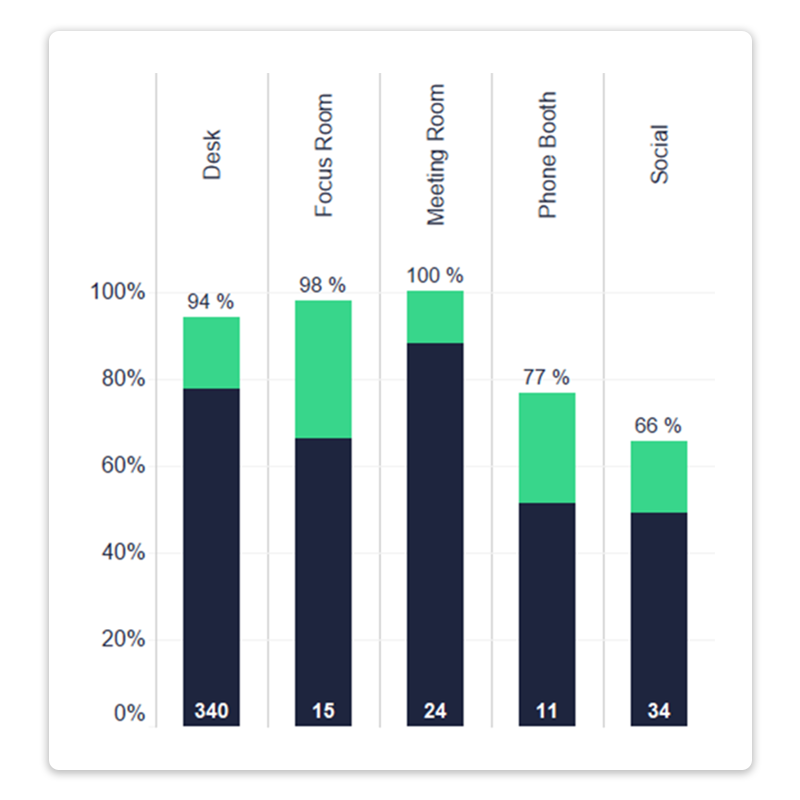

The improved floor design model was further tested by ramping up occupancy until occupancy reached Max again as demonstrated in the graph. The results showed an additional 67 people (320 people), representing 94% occupancy at peak, could use the floor before meeting and focus room spaces became unavailable.

The conclusion to the study proved that with relatively minor changes, minimal disruption and lower investment the whole office could be worked harder and be more efficient.

Key Takeaways

Unlocking deeper insights.

As a result of the analysis and recommendation from the Freespace Business Intelligence Team, using our analytics modelling and algorithms, the outcome was a data driven recommended floor plan change which resulted in:

✅ Significantly improved workplace experience with sustainable access to amenities and services.

✅ +26.5% increase in capacity on the floor – the optimized design increased capability for more people to use the floor without impacting access to meeting and focus room spaces.

✅ 21% reduction in cost per person on the floor.

✅ >£300,000 cost avoidance through not having to lease additional space.

Discover the full story in our FREE whitepaper.

Free Whitepaper

Right Size and Right Design your Workplace With Occupancy Metrics.

Gain a clear understanding of your current workplace portfolio and identify real-estate risks and opportunities.